Example: Couple with Young Kids

Example: Adam & Eve Sample Family

Disclosure:

The case study provided is for educational and illustrative purposes only and does not represent any specific recommendation. The strategies and financial products discussed may not be suitable for all investors, and the hypothetical results shown do not guarantee future performance. Investment strategies should be tailored to individual circumstances, objectives, and risk tolerance. Please consult with a qualified financial professional before making any financial decisions. Past performance is not indicative of future results, and all investments carry the risk of loss.

Note that this analysis is based upon where the family is right now. It also assumes that they stay in the same jobs with annual cost of living increases of 3%. If they have job changes, income changes, family changes, or other life events, we update their plan to adapt to their specific life changes.

Initial Information from the Sample Family

Adam (age 39) and Eve (age 37) are married with children Seth (age 6) and Angela (age 4).

Adam and Eve each make $75,000 per year with 10% bonuses ($7,500 each).

They have $1,300 in their checking account and $8,000 in a savings account at their bank.

They bought a home 5 years ago, have $10,000 of credit card debt, and have 2 cars with loan payments.

Adam has not started saving for retirement. Eve has saved $50,000 towards retirement in her job’s 401(k) plan.

Adam and Eve feel that they have income for some things that they enjoy, but are not as comfortable and able to save money as they would like.

Adam has retired parents that have very tight budgets.

Adam and Eve both want more comfortable financial future.

Adam and Eve Sample scheduled and attended a free introduction.

They chose to begin their journey with the Smart Start Steps to build their financial plan over time.

Smart Start - First Steps

Step: Understand My Goals

After a lively discussion of Adam and Eve’s needs, wants, and wishes for their lives, they agreed to start with the following goals:

Retirement at the same time, at age 67 for Adam and age 65 for Eve

Private school through high school for Seth and Angela that includes a small scholarship towards tuition

($9,000 per year for each child, with $2,000 scholarships for each child)

Home renovation in 5 years with $30,000 cost

Paying for 4 years of college for Seth and Angela (public, in-state, living on campus)

($28,840 per year as the national average)Their planner included estimated healthcare costs in retirement

($6,092 per year for healthcare in retirement and

$68,640 in long term care costs for each of the last 2 years of life at ages 88 & 89)

Smart Start - First Steps

Step: Show Where I Am Now

This is an important summary of their current financial state,

so that a custom plan for how to change it as needed can be created in a positive, confidential, judgement-free space.

SUMMARY

Net Worth of $128,995 (value of what is owned, minus debt)

Assets: $9,300 in bank accounts, $50,000 in retirement accounts, $123,154 in home equity

Liabilities/Debt (excluding mortgage): $10,000 in credit card debt, $43,459 in auto loans

Expected Debt Payoff Date (excluding mortgage): September 2028 with about $9,614 of interest

Monthly cash flow of -$566 (spending $566 per month more than what comes in)

Household annual salary income of $165,000 this year: $150,000 in total salaries and $15,000 of total bonuses

Household salary income of $12,500 per month from salaries, though there is an average of $13,750 per month of income after bonuses are used throughout the year

Household expenses are $13,066 per month

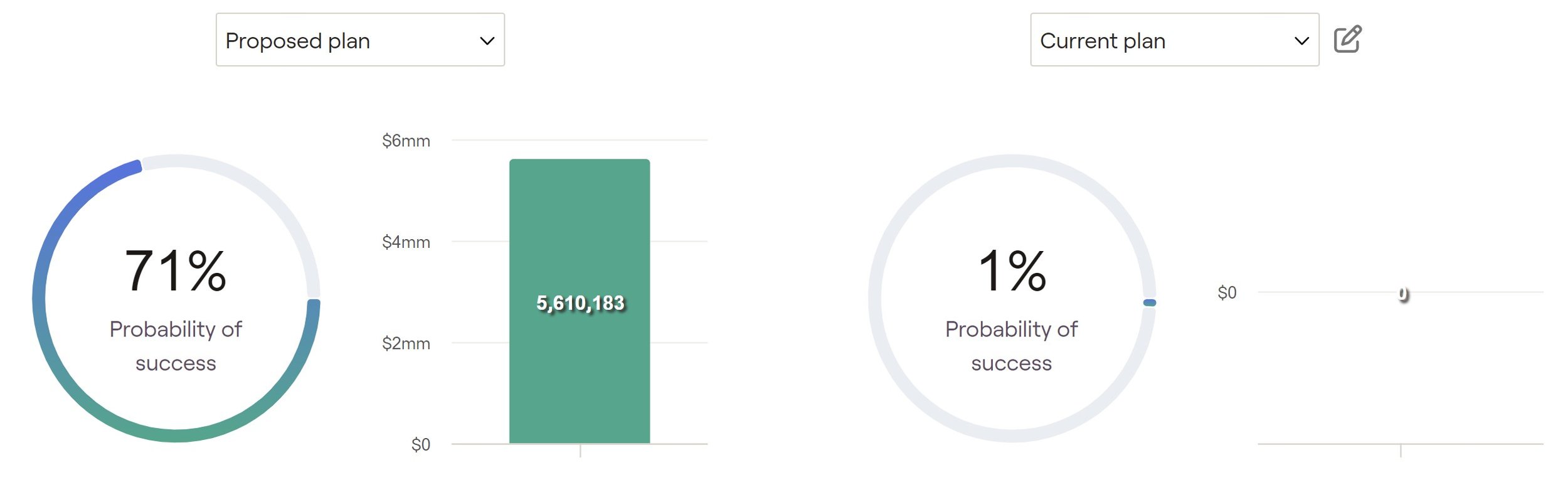

Simulated projections: 1% chance of achieving all goals, starting retirement with $162,401, and having $0 at the end of both lives

(Don’t be alarmed -- we can improve that!)Assumes that Adam retires at 67 and Eve retires at the same time at 65

The Sample Family may run out of money to cover expenses when Adam is 68

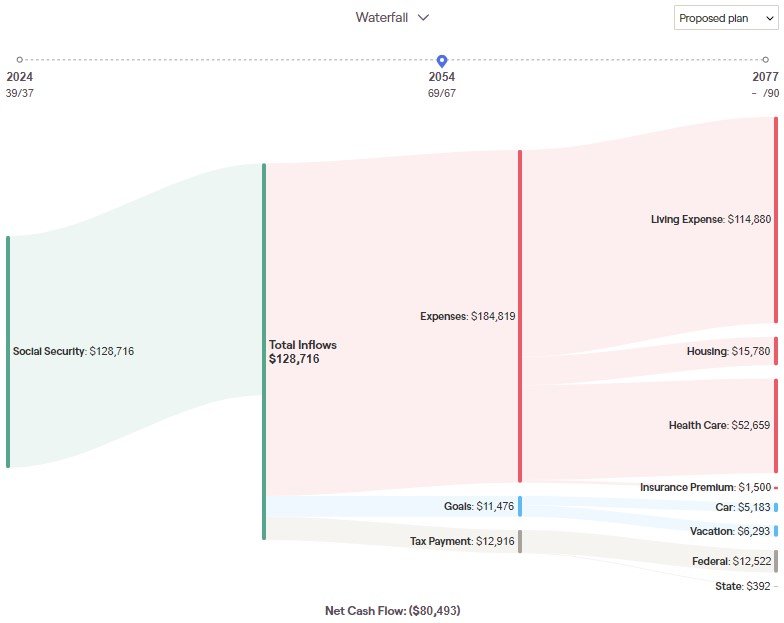

Yearly Cash Flow, or Income and Expenses

This image displays income for the year on the left in green and areas where it is spent to the right of the green section. The Net Cash Flow is -$3,338, which means that they are spending more than their income and they have adding debt.

Simulated Projections for Retirement and Achieving Goals

Simulations are calculated by running projections 1,000 times for a range of better and worse results. Probability of success is determined by how often “success” of having more than zero assets at the end of the plan (age 90) occurs. The second diagram displays the expected amount of assets for Adam at each age. Investment assumptions are 50% equity and 50% fixed income with 7% annual return and 9.7% standard deviation.

They could retire when Adam is age 67 with estimated savings of $162,401

1% chance of reaching all goals and $0 at the end of both lives

They may run out of money to cover expenses when Adam is age 68

Don’t be discouraged — this can change!

Smart Start - First Steps

Steps: Max My Income & Cut My Debt

Step: Max My Income

It is recommended that they spend $800 less each month on certain flexible costs.

Step: Cut My Debt

The Sample Family currently pays $350/month towards credit card debt.

they adjust how they pay debt and pay an average of $80 more per month for 2 years.

In 2 years: all credit card debt paid off (currently $10,000)

In 3 years: all debt outside of mortgage paid off (currently $53,549)

Savings of $5,496 in interest and payoff 1 year earlier

These changes immediately bring them to spending less than their income and begin to increase the chances of reaching their goals.

Smart Start - First Steps

Step: Jumpstart My Saving & Investing

Emergency Fund Savings

It is recommended that the Samples finish building their emergency fund over time. The emergency fund can be used when unexpected costs or loss of income takes place so that they can avoid using debt in those situations. Since they have two household incomes, this should consist of 3 months of essential living expenses. Their monthly essential expenses are $5,380/month and their goal is $16,140. They currently have $8,000 in their savings account as their Emergency Fund, which is about 1.5 months of essential living expenses. They should aim to save an additional $8,140.

To build this, it is recommended that they save $25 per week, or $100 per month (which allows them to skip a couple of weeks per year). This will help them to save over $1200 per year, as a starting point.

Retirement Savings In Work 401(k) Plans

It is recommended that Adam starts to save for retirement and that Eve increases her retirement savings by contributing a total of an additional $375/month.

Yearly Cash Flow after Jumpstart My Saving & Investing

This image displays income for the year on the left in green and areas where it is spent to the right of the green section.

Simulated Projections After Jumpstart My Saving & Investing

Simulations are calculated by running projections 1,000 times for a range of better and worse results. Probability of success is determined by how often “success” of having more than zero assets at the end of the plan (age 90) occurs. The second diagram displays the expected amount of assets for Adam at each age. Investment assumptions are 50% equity and 50% fixed income with 7% annual return and 9.7% standard deviation.

55% chance of reaching all goals and $1,025,017 at the end of both lives

They could retire when Adam is age 67 with an estimated $2,028,104

12.5 times and $1.86 Million more than their current state

They are more likely to be able to fund their full lives and leave money as an inheritance, though a higher probability of success that is around 80% is desired. There is still a projected 45% chance that they could run out of money in this situation.

Note that very few goals, no major purchases, little college funding, little travel and entertainment, and few wants and wishes are included. We can now build upon this foundation to add more of the life of which the Sample Family dreams.

This is a great start, though there is even more that they can achieve!

Smart Start - Middle Steps

Step: Pick My Employee Benefits

The benefits that are available through Adam’s job and Eve’s job were analyzed to determine which benefits should be used at each of their jobs.

The benefits that are available through Adam’s job and Eve’s job were analyzed to determine which benefits should be used at each of their jobs. Recommendations on the best fit for the following were made:

· Health insurance coverage

· Flexible spending accounts

· Health savings accounts

· Insurance policies

· Other workplace benefits

Smart Start - Middle Steps

Step: Pick My Work Retirement Plan Investments

Although Adam and Eve began to make better use of their work retirement plans, they did not know which funds to select from those that are available in their plans.

Adam has just begun to save towards retirement in his 401(k). Eve had some retirement savings in her 401(k) and those existing investments were analyzed. It was found that 80% was in equities, 10% was in fixed income, and 10% was in cash. The performance and the amount of change for Eve’s 401(k) was also analyzed.

Adam and Eve answered questions about their comfort with investment risk on surveys called risk assessments. This started a great discussion with their planner of the ideal investment style for each person and their household. Adam has never invested, but is eager to grow some savings as Eve has done. Eve has believed in always saving some money and has some comfort with investing and taking moderate risk. Eve confirmed that her current investments in her 401(k) moved up and down a bit more than she preferred. Adam and Eve agreed to an investment risk that is between that of Adam and Eve, but closer to Eve.

The investments that are available in each 401(k) plan were reviewed and recommendations on how contributions that should be put into each account were provided.

For example:

For Adam’s 401(k): 30% in A, 15% in B, 10% in C, 15% in D, 20% in E, 10% in F.

For Eve’s 401(k): 25% in G, 25% in H, 10% in I, 15% in J, 15% in K, 10% in L.

Smart Start - Middle Steps

Step: Review My Current Insurance and Needs

Adam and Eve both have $200,000 20-year term policies that expire in 2042.

To meet their needs, Adam needs to add at least $350,000 in life insurance and Eve needs to add at least $400,000 in life insurance.

It was recommended that Adam and Eve target at least $500,000 term life policies that are at least 20 years, and ideally longer, like 30 years. The price difference was very small to get slightly more coverage.

Adam and Eve are leveraging short-term disability and long-term disability policies through their employers.

Note that the probability of success dropped very slightly from 55% to 53% because there is a small cost for insurance and this projection assumes that Adam and Eve both pass away at age 90.

If one of them were to pass away before age 90, the spouse is projected to have their financial needs met for their lifetime if the proposed insurance is set up .

Smart Start - Middle Steps

Step: My Plan That Lives On

Adam and Eve had never discussed their wishes if either of them passed away.

Their wishes were discussed and the initial steps to begin estate planning that do not require attorneys were completed.

For drafting of final estate documents such as wills and trusts, Adam and Eve obtained an estate attorney and consulted with their planner as needed for support.

Smart Start - Middle Steps

Step: Max My One-Time Income

How should Adam and Eve make the most of their next bonuses?

For the upcoming year and the next year, Adam and Eve can use this money to cover monthly expenses that include paying off debt. 3 years from now, when their debt outside of their mortgage is paid off, bonuses could be used to help with funding other goals.

Smart Start - Last Steps

Step: Review My Current Investments

Currently, Eve’s only investments are in her 401(k) through her current job and investment recommendations were made in the earlier “Pick My Retirement Plan Investments” step.

If Adam and Eve had investments elsewhere, a review of the types and performance of those investments would be made in order to display how those investments might align with assisting them with meeting their goals.

We will create a plan for how to reach ALL of the education, home renovation goals, and retirement goals at one time.

Smart Start - Last Steps

Step: Fund My Life Goals (1st Look)

The Sample Family’s education and retirement goals will be discussed in the next sections. The $30,000 home renovation in 5 years is expected to cost about $34,000 after inflation.

After the plan for saving funds towards the home renovation was added, the probability of achieving goals increased from 53% to 57%.

Cash flow in the year of renovation:

Smart Start - Last Steps

Step: Fund My Family’s Education

At this point, Adam and Eve have an 83% chance of paying for Seth’s education goals and may need to have another $57,750. They are expected to be able to pay for all of Seth’s education before college and the first 2 years of college. Seth’s 3rd and 4th years of college are Angela’s 1st and 2nd years, so we will need to plan for these years with the most education costs.

At this point, Adam and Eve have an 82% chance of paying for Angela’s education goals and may need to have another $70,844. They are expected to be able to pay for all of Angela’s education before college. Seth’s 3rd and 4th years of college are Angela’s 1st and 2nd years, so we will need to plan in advance for these 2 years with double the education costs. Although Adam and Eve would only be paying for Angela’s 3rd and 4th years after Seth completed his 4 years, they will have spent heavily on education for the prior 4 years.

Total College Costs for Seth and Angela are expected to total $495,115. After the home renovation in 5 years, the Sample Family is able to invest monthly towards education savings, increasing the amount slightly for inflation each year until Angela graduates from high school in 8 years.

Between this college savings, their normal cash flow, and some withdrawals from their emergency fund savings, they are expected to be able to fully pay for pre-college and college education.

Smart Start - Last Steps

Step: Plan My Retirement Age & Lifestyle

After education costs are complete, Adam and Eve are able to save about 23-28% of their salary in the 10 years before they retire. Each of them will start to take their Social Security benefits at full retirement age of 67, which is their 1st and 3rd year of retirement.

Although Adam had not started saving for retirement at age 39 and Eve had saved $50,000 towards retirement by age 37,

Adam and Eve are able to achieve the following:

A partial renovation of their home

Paying for private school for their kids through high school

Paying for 4 years of college for each of their kids

Retirement at the same time at the standard retirement age for Adam with a very high chance of having money during retirement

Leaving an inheritance of over $12 Million

Simulated Projections

Simulations are calculated by running projections 1,000 times for a range of better and worse results. Probability of success is determined by how often “success” of having more than zero assets at the end of the plan (age 90) occurs. The second diagram displays the expected amount of assets for Adam at each age. Investment assumptions are 50% equity and 50% fixed income with 7% annual return and 9.7% standard deviation.

90% chance of reaching all goals and $12,453,197 at the end of both lives

(80% change is the target)

They could retire when Adam is age 67 with an estimated $3,558,430

22 times and $3.4 Million more than their current state

Now that Adam and Eve have a plan to meet their goals that they describe as “needs”, they can add more of their goals that they describe as “wants” and “wishes” to their plans.

Adam and Eve are able to add more of their goals that are “wants” and “wishes” to their plans and still retire comfortably. They added the following goals and are still able have a successful retirement:

Purchase of 2 new cars every 10 years

A vacation budget that starts in 3 years

$20K (today’s dollars) for each child towards a wedding or home down payment

Simulated Projections

Simulations are calculated by running projections 1,000 times for a range of better and worse results. Probability of success is determined by how often “success” of having more than zero assets at the end of the plan (age 90) occurs. The second diagram displays the expected amount of assets for Adam at each age. Investment assumptions are 50% equity and 50% fixed income with 7% annual return and 9.7% standard deviation.

80% chance of reaching all goals and $8,335,730 at the end of both lives

(80% is our target)

They could retire when Adam is age 67 with an estimated $3,321,759

20 times and $3.1 Million more than their current state

Although Adam had not started saving for retirement at age 39 and Eve had saved $50,000 towards retirement by age 37,

Adam and Eve are able to achieve the following:

A partial renovation of their home

Paying for private school for their kids through high school

Paying for 4 years of college by paying for some college direction and paying off kids’ student loans if loans are required

Retirement at the same time at the standard retirement age for Adam with a very high chance of having money during retirement

PLUS

Buying 2 new vehicles every 10 years

An annual vacation budget

Paying for most, if not all of the cost for weddings or home down payments for both Seth and Angela

Leaving an inheritance of over $8 Million