Services

Most of what we all need to know to make the best financial decisions for our lives is not taught in school. Where would we learn?

There is no shame in not knowing all of the answers.

Everyone can have access to great financial advice.

Service Approach

Financial planning is most effective when a full financial plan of how to accomplish your life goals is created, monitored, and adjusted over time. This plan includes guidance on what you need to save and invest in order to reach your goals.

Investing is most effective when it is done according to your financial plan so that you have confidence that you are taking the right actions now in order to meet your life goals.

Check out our examples of what financial planning can do for you.

What Services Fit My Needs?

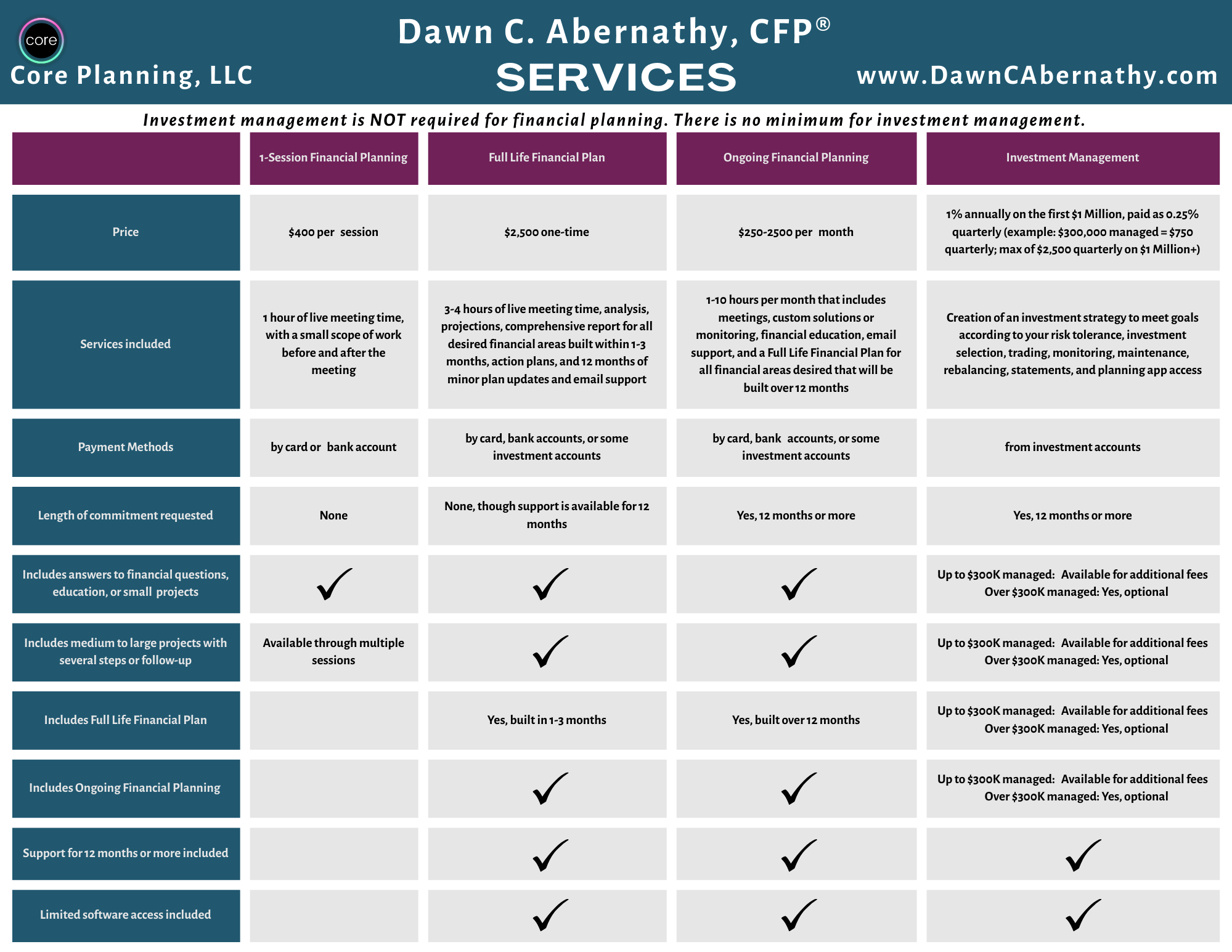

-

1-Session Financial Planning

Fast answers from a CERTIFIED FINANCIAL PLANNER® Professional or planning in small steps

-

Full Life Financial Plan

A personalized, comprehensive financial plan to meet your goals

-

Ongoing Financial Planning

Ongoing, personalized financial guidance and education

-

Investment Management

Investing services to start or continue saving and investing for the future

Did you know?

Financial planning can be provided as an employee benefit or gifted to someone else

1-Session Financial Planning & Advice

Fast answers from a CERTIFIED FINANCIAL PLANNER® Professional, only as you need it:

Guidance on budgeting, debt management, saving, and investing

Second opinions on advice, from a fiduciary that acts in your best interests

Financial wellness checks for DIY investors OR financial advice without investment management requirements

Advice before buying and selling anything, tax planning guidance, education savings, self-employment financial planning

Advice on choosing retirement accounts, employee benefits, or exercising company stock options

Much more — just ask about what you need

$400 per session

View availability and schedule now

Full Life Financial Plan

Wherever you are, you can plan how to reach your life goals.

Investment management is not required in order to use our financial planning services.

Create your full financial plan to change your financial life right away.

-

Full Life Financial Plan (with All Planning Areas)

ALL financial planning areas

12 months of Ongoing Financial Planning

__

$2,500

by card, bank accounts, or some investment accounts

Ongoing Financial Planning

You can have access to custom financial guidance and education beyond creation of a financial plan.

Examples

Financial guidance during life, work, or business changes

Financial guidance before, during, and after family changes such as partnering, marriage, children, or divorce

Financial guidance on life changes after the death of a family member

Financial guidance and planning for executives, entrepreneurs, NIL and professional athletes, entertainers, and other professions

Financial oversight and education to make sure that other wealth management, private banking, or other investment companies are doing what you expect

Financial planning representation in meetings or working with your business team (accountants, attorneys, agents, assistants, staff, etc.)

Monitoring, review, oversight, and education of actions of other financial professionals to ensure there is accountability

Other custom financial guidance or financial education needs

Investment management is not required in order to use our ongoing financial planning.

You can have the advantage of custom financial guidance for your needs.

-

Ongoing Financial Planning

Includes financial guidance as needed, assistance with financial decisions, monitoring or oversight of finances, and more, based upon the complexity of your needs.

A 12-month commitment is requested to maximize the impact and progress.

Includes an optional Full Life Financial Plan with a 12-month commitment

$250-$2,500 per month (based upon 1-10 hours per month of analysis, support, and meeting time)

by card, bank accounts, or some investment accounts

Investment Management

Investing is just one tool for reaching your goals in your financial plan.

It is important to invest the right amounts in the right types of accounts in the right types of investments with the right strategy and discipline in order to accomplish your goals.

With no minimum amount to start, you can have your investments managed professionally to empower your retirement, your family’s dreams, wealth-building, and other goals.

All investments are held at Schwab or Altruist as custodians. We use a long-term, low-cost investment approach to meet your life goals of your financial plan. Our investing is not automated. Investment management is not required in order to use our financial planning services.

Reach your goals with confidence with professional investment management.

ALL investment management includes creation of your investment strategy to meet your goals according to your risk tolerance, investment selection, trading, monitoring, maintenance, rebalancing, statements, and planning app access.

-

Ongoing Investment Management up to $300,000

Financial Planning can be added.

No financial planning services are required.

Annual fee of 1%

paid as 0.25% quarterly from accounts -

Ongoing Investment Management from $300,000 - $1,000,000

Includes optional Ongoing Financial Planning.

No financial planning services are required.

Annual fee of 1%

paid as 0.25% quarterly from accounts -

Ongoing Investment Management over $1,000,000

Includes optional Ongoing Financial Planning.

No financial planning services are required.

Annual fee of 1% for the first $1,000,000

equals a flat fee of $2,500 quarterly from accounts

There are also ways to empower others with understanding of how to meet their own financial goals through financial planning and education.

The Gift of Financial Planning

Did you know that you can make a life-changing gift

of a confidential, personalized financial plan

or planning services to someone else?

This could benefit people who are…

beginning their careers

making major life changes or financial decisions

recovering from financial hardship

joining with or separating finances from someone

wanting financial guidance but think it is not accessible

Employers: Financial Wellness

as an Employee Benefit

Financial concerns can be a source of stress for your employees, across various economic levels.

Did you know that financial wellness benefits are a great way to invest in the futures of your employees?

Attract and retain your employees with innovative benefits!

We provide confidential services for your staff without sharing details of sessions with employers. Charges are only billed to the employer as each employee begins to use services.

1-Session Financial Planning and Advice

(great for retirement planning, budgeting, debt, employee benefits assistance, company stock or option advice, etc.)Packages of 3 sessions of 1-Session Financial Planning and Advice

One-time Full Life Financial Plans

6-month or 12-month subscriptions for ongoing financial planning

Other custom packages